From the energy policy point of view, shale gas has become one of the main stakes in terms of strategy, economy and also independency. Every country is aware and conscious of its need to reduce greenhouse gas emissions. The long-term goal is to move to a totally renewable energy mix. The IAE is inflexible about it. In that context, should shale gas play a role? Should it be considered as a bridge technology before moving to green energy? Shale gas exploitation responds to logics of power. It appears that this exploitation can deeply disrupt energy markets and change the current trends.

Geopolitical and strategic considerations

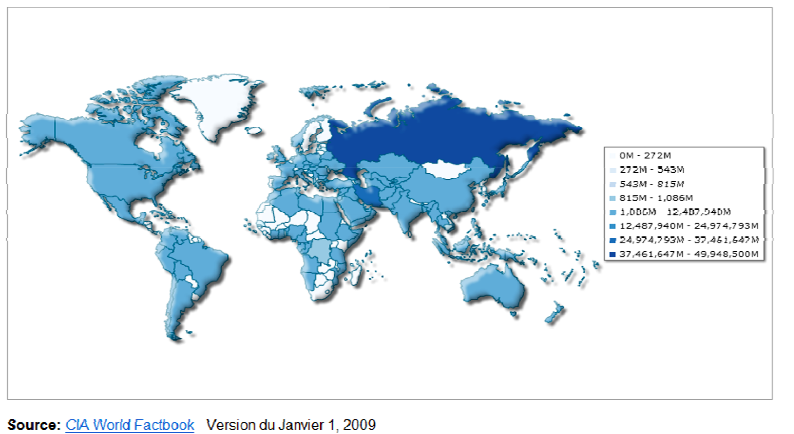

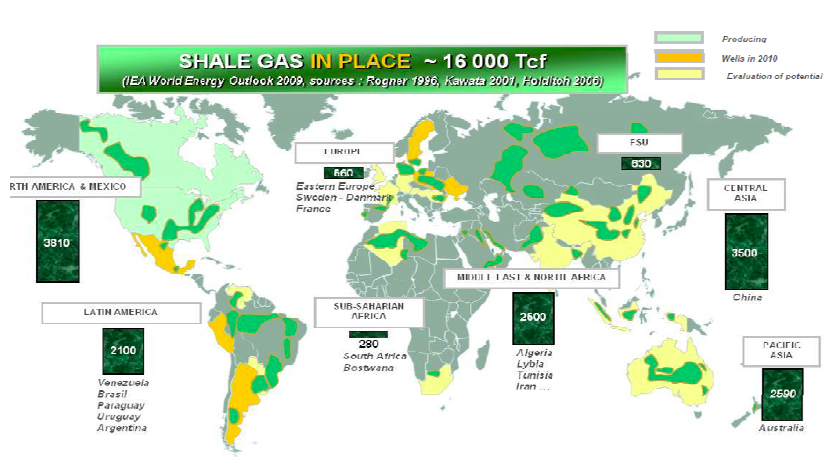

Energy independence is an important question that has to do with geopolitical stakes. According to scientific studies, Europe has important stocks of shale gas. The exploitation of these resources could put into question some of the contracts for natural gas supply that the European Union maintains in particular with Russia. The European energy supply dilemma does not concern a lack of resources but strategic stakes. Shale gas exploitation could be an alternative to the Russian predominance on the natural gas market. The International Energy Agency claims that the scale of non-conventional gas resources worldwide are comparable to conventional gas resources. However, considering the two maps below, it clearly appears that the localization of those resources is not similar at all.

Conventional gas resources over the world

Non-conventional gas resources over the world

Following the EU Council’s initiative on February 4th 2011 the exploration of non-conventional gas resources has been put forward: “in order to reinforce the security of the EU supply, it would be necessary to evaluate Europe’s potential regarding non-conventional fossil fuel resources, extraction and long-term use.” In response to this announcement, a partnership has been concluded between the US and the EU and more than 90 exploration licenses have been granted on EU territory.

European dependency on fossil fuel imports from Russia remains a sensitive issue. The Russian energy supplier Gazprom provides more than 25% of the natural gas consumed in the EU. By stopping its gas supplies to Ukraine in recent years, Russia has proven that it ownes one of the most effective pressure tactics. Therefore some shale gas defenders consider the main interest of shale gas to be in terms of supply security. All major energy companies put this argument forward in order to convince the different governments of the benefits that shale gas may provide.

For the moment, European exploitation of non-conventional gas resources has to deal with a number of problems. First, the European industrial base is not adapted to such an exploitation. Secondly, the mining system is far from being as freely accessible as it is in the US. Finally, the EU has never been successful in implementing a global energy strategy so far.

In France, the “Environment Grenelle” compels the government and the main energy actors to invest in renewable and clean energies. Shale gas is clearly in opposition with those engagements.

Shale gas is very often considered as an alternative to petroleum, to nuclear and to imported natural gas, so it would represent a significant strategic interest: energy independence. Shale gas opponents put forward that reserves in each well are not as important as companies estimate them to be. They also affirm that the exploitation of each drilling should not overpass 10 years, opposed to 20 years in the US. Moreover, some associations wonder why companies do not try to reach energy independence by developing alternatives that would be less polluting.

Current energy consumption and resources in France should be considered relative to the economic stakes of shale gas exploitation. The economic consequences of a future energy policy for France play an important role in decision-making.

French energy consumption continues to grow, but when it comes to research and political support in the field of renewable energies, France laggs behind. Therefore it appears that fossil fuels will remain crucial in the coming years. As far as shale gas could be less polluting than other fossil fuels, the question is whether it should be brought in to complement the renewables.

Natural gas amounts up to 15% of the French energy consumption, but the exploitation at national level is almost ineffective. Gas and oil imports cost 45 billion € in 2010. Shale gas exploitation would partially substitute those importations and reduce the energy bill of the country. According to a report published by the French parliament on shale gases and oils in June 2011, both Poland and France dispose of the largest shale gas deposits across Europe. The Strategic Analysis Center values its possible benefit to 3 billion € in terms of foreign trade. France could thereby play a leading role in Europe. What is at stake now is to assume a position relative to shale gas exploitation between the major Russian gas suppliers and the United States being the most important producer of shale gas worldwide.

However, several reports raised doubts about the profitability of shale gas exploitation. According to the scientist and author Normand Mousseau one might compare the controversy around shale gas to the Internet bubble of the early 2000s. He explains that gas is sold around 4$/GJ but in fact costs 6$/GJ to produce. Similarly, an article published in the New York Times in January 2011, claimed that the exploitation of shale gas would be „inherently unprofitable“.